|

With its strategic location at the doorstep of Mainland China and in a time zone

that bridges the gap between Asia and Europe, Hong Kong serves as an excellent

global centre for trade, finance, business and communications. Hong Kong is now

the 11th largest trading entity in the world. It operates one of the busiest container

ports in the world in terms of throughput, as well as one of the busiest airports in

terms of number of passengers and volume of international cargo handled. In

addition, it is the world's 14th largest banking centre in terms of external banking

transactions, and the sixth largest foreign exchange market in terms of turnover. Its

stock market is Asia's second largest in terms of market capitalisation.

Hong Kong is noted for its high degree of internationalisation, its business-friendly

environment, the rule of law, free trade and the free flow of information,

open and fair competition, its well-established and comprehensive financial network,

a superb transport and communications infrastructure, sophisticated support services

and a well-educated workforce complemented by a pool of efficient and enterprising

entrepreneurs.

In addition to this are its substantial amount of foreign exchange reserves, a fully

convertible and stable currency, prudent fiscal reserves and a simple tax system with

a low tax rate. Hong Kong was also ranked as the world's freest economy by the US

Heritage Foundation for the 13th year in a row in 2006. It is also ranked consistently

as the first by the Fraser Institute of Canada.

Hong Kong's economy nearly tripled in size over the past two decades, with

GDP soaring at an average annual rate of 5.1 per cent in real terms. This surpasses

both the world's ecomomic growth of 3.7 per cent and the 2.8 per cent growth

recorded by the Organisation for Economic Cooperation and Development (OECD)

economies. Over the same period, Hong Kong's per capita GDP has doubled, chalking

up an average annual growth rate of 3.9 per cent in real terms. At US$27,680, Hong

Kong's per capita GDP was one of the highest in Asia in 2006 (Chart 1).

| Chart 1 |

| Gross Domestic Product |

| (year-on-year rate of change in real terms) |

|

|

|

Hong Kong's economic openness fits well the aspirations of globalisation. Hong

Kong's eight-fold increase in merchandise exports and three-fold jump in services

exports in the past two decades are due partly to this openness. In 2006, the total

value of visible trade (comprising re-exports, domestic exports and imports of goods)

reached $5,044 billion, equivalent to 342 per cent of GDP. This was considerably

larger than the ratios of 171 per cent in 1986 and 237 per cent in 1996. If the

value of exports and imports of services is also taken into account, the ratio is even

greater, at 400 per cent in 2006, as compared with 210 per cent in 1986 and

275 per cent in 1996.

The stock of inward direct investment in Hong Kong, amounting to

$4,056 billion in market value at the end of 2005, equivalent to 293 per cent of

GDP, was another strong indication of Hong Kong's increasing international focus.

Hong Kong is the second most favoured destination for inward direct investment in

Asia, next only to the Mainland. The corresponding figures of $3,654 billion and 264

per cent for the stock of outward direct investment in Hong Kong were likewise

substantial, and were much larger than those of many other economies in Asia. As a

major financial centre in the region with huge cross-territory fund flows, Hong Kong's

external financial assets and liabilities were also substantial, at $11,588 billion and

$8,182 billion respectively at the end of 2005. The corresponding ratios to GDP in

that year were 838 per cent and 592 per cent. Reflecting Hong Kong's sound

international investment position, net external assets rose to $3,406 billion at the

end of 2005, equivalent to 246 per cent of GDP.

The Gross National Product (GNP), comprising GDP and net external factor

income flows, stood at $1,479 billion in 2006. This was slightly higher than the

corresponding GDP by 0.3 per cent. The difference represented a net inflow of

external factor income. In gross terms, inflows and outflows of external factor

income remained substantial in 2006, at $643 billion and $638 billion respectively,

equivalent to 44 per cent and 43 per cent of GDP respectively. This was related to

the huge volume of both inward and outward investment in Hong Kong.

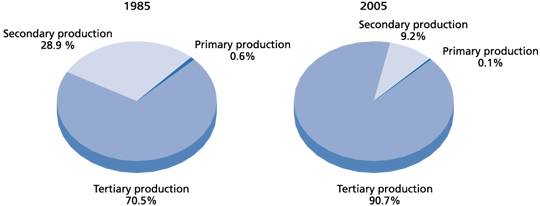

Contributions of the Various Economic Sectors

Primary production, including agriculture, fisheries, mining and quarrying, is

insignificant in Hong Kong, in terms of both its value-added contribution to GDP and

share in total employment. This reflects the predominantly urban economy.

Secondary production, comprising manufacturing, construction, and supply of

electricity, gas and water, which made a significant contribution to GDP up to the

early 1980s, has since decreased in importance. Within this broad sector, the value-added

contribution from manufacturing shrank from 21 per cent in 1985 to 8 per

cent in 1995 and to only 3 per cent in 2005 as a result of the relocation of the more

labour-intensive production processes to the Mainland. The construction sector's

contribution to GDP stayed at around 5 per cent between 1985 and 2000, before

edging down to 3 per cent in 2005. The supply of electricity, gas and water

remained relatively stable, with a share of around 2-3 per cent of GDP over the past

two decades.

Hong Kong's economy has become increasingly service-oriented since the 1980s.

The Mainland's open-door policy and economic reform have not only provided an

enormous production hinterland and market outlet for Hong Kong's manufacturers,

they have also created abundant business opportunities for a wide range of services.

Hong Kong has continued to move towards service activities, prompted by the

changing regional and global economic environment and also by closer integration

with the Mainland. In particular, while the thriving Mainland economy has provided

ample business opportunities for Hong Kong's service sectors, the availability of

cheaper land and labour on the Mainland and its rising productivity have also

prompted Hong Kong to move swiftly up the value chain.

As a result, the share of the tertiary services sector, comprising the wholesale,

retail and import/export trades; restaurants and hotels; transport, storage and

communications; finance, insurance, real estate and business services; community,

social and personal services and ownership of premises, in GDP went up noticeably,

from 71 per cent in 1985 to 85 per cent in 1995 and 91 per cent in 2005

(Chart 2). There was a similar development on the employment front (Chart 3).

| Chart 2 |

| Gross Domestic Product by broad economic sector |

|

|

|

| Chart 3 |

| Employment by broad economic sector |

|

|

|

The Services Sector

The services sector has not only flourished but also diversified to match the

economy's structural transformation. Trade-related and tourism-related services,

community, social and personal services, and finance and business services such as

banking, insurance, real estate and a host of related professional services have all

grown significantly over the past two decades. Information technology (IT) has

also expanded considerably in more recent years — especially IT related to

telecommunications services and internet applications — in line with the shift in the

economic structure towards more knowledge-based activities.

Because Hong Kong is a highly service-oriented economy, its services sector has

long been the dominant driving force of overall economic growth. Over the past five

years, the value-added component of the services sector as a whole grew by a

cumulative 39 per cent in real terms, surpassing the corresponding 31 per cent

growth of the economy. Among the constituent service sectors, financing and

insurance showed the fastest cumulative growth of 89 per cent, reflecting the

increasingly prominent role of Hong Kong as an international financial sector. Import

and export trade also performed impressively, registering an 81 per cent jump in

value during the period. This, together with the notable growth of 37 per cent in

transport and storage services, reflects Hong Kong's competitive edge in the trading

and logistics sectors, riding on the back of the Mainland's vibrant trade flows. The

communications sector also fared strongly, showing a cumulative 68 per cent growth

in added value bolstered by rapid technological advancement in this sector and also

by Hong Kong's role as a communications-cum-business hub in the region.

In 2006, the value-added part of the services sector as a whole rose by 9 per

cent in real terms. Financing and insurance, communications, and import and export

trade continued to be the best performers. Restaurant and hotel business also grew

notably due to stronger domestic demand and a further rise in the number of visitors

to Hong Kong.

In 2005, the services sector's contribution to GDP was 91 per cent. The

wholesale, retail and import/export trades, restaurants and hotels continued to be the

largest services sector, accounting for 29 per cent of value-added contribution to

GDP. This was followed by finance, insurance, real estate and business services, which

amounted to 22 per cent; community, social and personal services, 19 per cent; and

transport, storage and communications, 10 per cent (Chart 4). As for the four key

industries, trading and logistics accounted for 29 per cent of value-added

contribution to GDP in 2005; financial services, 13 per cent; and tourism, 3 per cent.

The corresponding contribution of professional and other producer services was

11 per cent.

| Chart 4 |

| Gross Domestic Product by major services sector |

|

|

|

In September 2006, the Economic Summit on 'China's 11th Five-Year Plan and

the Development of Hong Kong' was held to discuss how Hong Kong should respond

to the challenges and opportunities arising from the National 11th Five-Year Plan,

which unequivocally supports Hong Kong in the development of its services industries

such as financial services, logistics, tourism and information services; and the

maintenance of its status as an international centre of financial services, trade, and

shipping. After four months of intensive work, the four Focus Groups of the

Economic Summit submitted their reports together with their proposed Action

Agenda to the Chief Executive in January 2007. A total of 50 strategic proposals and

207 action plans were proposed by the four Focus Groups. They aimed at enhancing

Hong Kong's status as an international trade and business centre, developing Hong

Kong as China's international financial centre of global significance, and leveraging

on Hong Kong's air transport, shipping and high-value logistics experience to

strengthen its status as an international maritime centre, and air transport and

logistics hub.

The economy's shift towards the services sector was also borne out of a shift in

the sectoral composition of employment. Over the past two decades, the services

sector's share of total employment went up from 55 per cent in 1986 to 80 per cent

in 1996 and 86 per cent in 2006 with wholesale, retail and import/export trades,

restaurants and hotels accounting for 34 per cent of the total workforce. This was

followed by community, social and personal services with a 26 per cent share;

finance, insurance, real estate and business services with 16 per cent; and transport,

storage and communications, 11 per cent (Chart 5).

| Chart 5 |

| Employment by major services sector |

|

|

|

The Manufacturing Sector

Hong Kong's manufacturing sector is expected to continue to be versatile and

flexible in coping with changing market demands. Its output has grown considerably,

aided by its increased manufacturing arrangements with the Mainland.

Manufacturing efficiency and product quality are also expected to be upgraded

continuously with the help of modern technology. Hong Kong manufacturers are also

producing more knowledge-based products as well as products with a higher value-added

content. Although the manufacturing sector's direct value-added contribution

is not a big contributor to the economy, its well-established links with the Mainland

economy provide huge opportunities for Hong Kong's services sector to grow.

Economic Links between Hong Kong and the Mainland

Since the start of the Mainland's open door policy in 1978, Hong Kong's

economic links with the Mainland have grown stronger by the day bringing enormous

benefits to both places over the past 30 years. The huge flow of goods, services,

people and capital between Hong Kong and the Mainland and between the Mainland

and the world via Hong Kong have created remarkable financial growth and job

opportunities in both Hong Kong and the Mainland.

Visible trade between Hong Kong and the Mainland has grown 216-fold since

1978, at an average annual rate of 21 per cent in value terms. Growth remained

impressive in 2006, at 14 per cent (Chart 6). Along with the sustained strong growth

in bilateral trade, Hong Kong and the Mainland ranked as the 11th and the third

largest trading entity in the world.

| Chart 6 |

| Visible trade between Hong Kong and the Mainland |

|

|

|

The Mainland has long been Hong Kong's largest trading partner, accounting for

46 per cent of Hong Kong's total trade in 2006. Ninety-one per cent of Hong Kong's

re-export trade was related to the Mainland in 2006, making it the largest market for

as well as the largest source of Hong Kong's re-exports. On the other hand, Hong

Kong was the Mainland's fourth largest trading partner after the European Union,

United States and Japan, accounting for 9 per cent of the Mainland's total trade in

value terms in 2006.

Hong Kong is also the main gateway to and from the Mainland for business and

tourism. The number of trips made by foreign visitors to the Mainland through Hong

Kong rose by a cumulative 85 per cent in the past 10 years, or at an average annual

growth rate of 6 per cent, representing 4.2 million trips in 2006. Conversely, the

number of trips made by Mainland residents to or through Hong Kong rose more

than five-fold, at an average annual growth rate of 19 per cent, equivalent to

13.6 million trips in 2006.

Hong Kong continues to be the largest external investor in the Mainland.

According to the Mainland statistics, the cumulative value of Hong Kong's realised

direct investment in the Mainland reached US$280 billion at the end of 2006,

accounting for 41 per cent of total inward direct investment there. Over the years,

Hong Kong had shifted gradually from investing in manufacturing on the Mainland to

investing in a wider spectrum of business ventures such as hotels and tourist-related

facilities, real estate and infrastructure development. Hong Kong has closer economic

links with Guangdong than other places on the Mainland. By the end of 2005, the

cumulative value of Hong Kong's realised direct investment in Guangdong was

US$105 billion, or 65 per cent of the province's total inward direct investment.

Hong Kong's extensive investment in the Mainland has contributed to China's

industrial development and the city's economic transformation.

The Mainland is likewise Hong Kong's largest source of foreign direct

investment. By the end of 2005, the Mainland had invested US$164 billion in Hong

Kong, accounting for 31 per cent of all investments in Hong Kong. According to

Chinese statistics, there are over 2 600 mainland-backed enterprises operating in

Hong Kong enjoying easier access to global funding and the opportunity to extend

their businesses to overseas markets. Such investments help boost Hong Kong's

position as the region's leading services hub.

China's state-owned commercial banks have established a significant presence in

Hong Kong. For instance, the Bank of China (Hong Kong) Limited is one of the

largest banking groups in Hong Kong. Other state-owned banks, such as the China

Construction Bank, the Industrial and Commercial Bank of China and the Agricultural

Bank of China, were all granted banking licences in 1995 to operate in Hong Kong.

At least two of them have been making sizable mergers/acquisitions in Hong Kong

through its subsidiaries to expand their Hong Kong banking network. As regards

banking business on the Mainland, the HSBC Group, the Standard Chartered Bank

and the Bank of East Asia are among the best-represented foreign banks on the

Mainland.

Hong Kong is also a major funding centre for Mainland enterprises. By the end

of December 2006, a total of 367 Mainland enterprises were listed on Hong Kong's

stock market. Among them, 39 were listed in 2006, raising equity capital amounting

to $303.8 billion. The more prominent listings in 2006 included that of the Industrial

and Commercial Bank of China Ltd, Bank of China Limited, China Merchants Bank

Company Ltd, China Communications Construction Company Limited and China

Coal Energy Company Limited. These listings have helped broaden the base of Hong

Kong's stock market, and entrenched further Hong Kong's position as a major fund-raising

centre in the region.

The Hong Kong Government and the Central People's Government (CPG)

reached an agreement on October 18, 2005 to further liberalise measures governing

Hong Kong's trade with the Mainland. Under Phase 3 of the Closer Economic

Partnership Arrangement (CEPA), all products of Hong Kong origin were given tariff-free

entry into the Mainland starting from January 1, 2006. By the end of 2006, over

19 000 certificates of Hong Kong origin had been issued, covering exports valued at

around $6.8 billion. CEPA has enabled Hong Kong companies to save up to

$618 million in tariffs since it went into effect three years ago.

On the services side, 15 new liberalisation measures spreading across 10 services

sectors1 were agreed with the CPG on June 27, 2006. By the end of 2006, there

were altogether 27 services sectors benefiting from CEPA and nearly 1 700 Hong

Kong Service Supplier Certificates had been issued. These CEPA concessions give

Hong Kong companies a 'first mover' advantage in the Mainland market, and foster

better synchronisation of the chain of cross-boundary financial activities, goods

production and distribution. The improvement in efficiency and productivity help

reduce transaction costs significantly benefiting both Hong Kong and the Mainland.

The trade and investment facilitation measures under CEPA also help increase the

flow of investment between the two places.

With continuing reform and further liberalisation of the Mainland economy,

particularly after its entry into the World Trade Organisation, more foreign investment

are expected to flow into the Mainland. Hong Kong's role as a service hub for the

Mainland will continue to strengthen. Apart from being a springboard into the

Mainland for foreign enterprises, Hong Kong also acts as a platform for Mainland

enterprises to tap overseas markets, which is increasingly important for Mainland

enterprises as they grow bigger and become more international.

|